Expertise and tools for smarter loan reviews and credit intelligence.

Benefit from credit insights, streamlined loan reviews and huge time savings — with these loan review services and cloud-based solutions designed by credit experts.

Our Satisfied Customers

IntelliCredit’s Loan Review Service Delivers Huge Time Savings.

IntelliCredit: Game-changing Loan Review Services Plus Solutions for

Your Internal Team

-

Smart Loan Review™ Service

Loan Review Services performed by credit experts

IntelliCredit delivers game-changing loan reviews that combine Deep Credit Expertise and an Online, Real-time Portal. Your credit union benefits from huge time savings, process transparency, plus fewer meetings and intrusions. -

Smart Loan Review™

Cloud-Based Application for your internal loan review team

Revolutionary solution that helps internal teams automate and expedite the loan reviews they perform, making the process simple, organized, retrievable, and fast. -

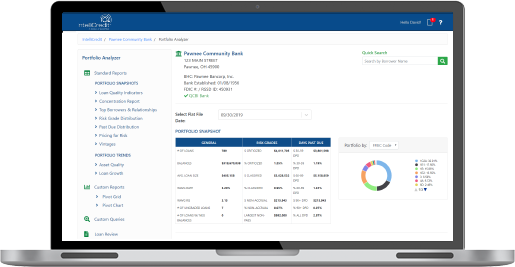

Portfolio Analyzer

Cloud-Based Application for credit intelligence

Delivers insightful analysis of your portfolio and loan data so you can identify hotspots, detect risk earlier, and write your own credit script – before the regulators do it for you.

IntelliCredit: Built by Credit Specialists

Unlike so many risk-focused fintech tools, IntelliCredit was created by true credit specialists whose decades of expertise in managing and analyzing credit risk inform every data point, chart, calculation and process.

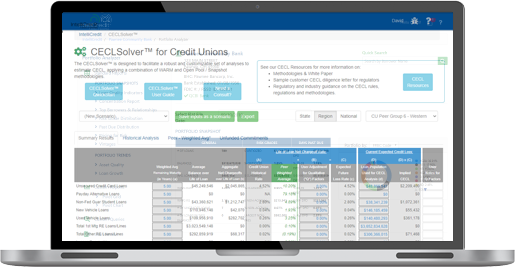

"I gave our auditors and the examiner my package of reports prepared with CECLSolver and explained my methodology for determining our WARM calculations. Thank you again for providing such an easy to use solution!"

–Kathy Briggs, CEO, The Family First Federal Credit Union

CECLSolver® for Credit Unions – Simple, Practical, Affordable

- CECL compliance doesn't have to be complicated or costly

- Simply edit a template to create loss estimates and reports

- Meet regulatory expectations with a tool built on regulators' guidance

- Easily calculate your Weighted Average Remaining Maturity

- Do it yourself, or we can assist you

- Ask about our 30-day FREE trial

Rely on the service quality that only QwickRate and IntelliCredit provide.

- 30+ years focused on serving community credit unions

- Credit risk specialists to help inform your decisions

- Great customer support from dedicated experts eager to help